georgia personal property tax exemptions

Click here or call 706-253-8700 for Personal Property Tax Exemption Information at Pickens County Georgia government. And federal government websites often end in gov.

Tax Comparison Florida Verses Georgia

Any Georgia resident can be granted a 2000 exemption from county and school taxes.

. While the state sets a minimal property tax rate each county and municipality sets. In Georgia property tax is a tax on the value of all real and tangible property unless exempt. And according to the Tax Foundation one of 16 other states.

Co-located data centers and single. State of Georgia government websites and email. Certain properties are exempt from ad valorem taxes based on ownership and use of the property.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. New signed into law May 2018. Georgia offers two possible ways for data centers to qualify for sales and use tax exemptions on qualifying purchases.

Property owner is a nonprofit. Individuals 65 Years of Age and Older. 1266 E Church Street Suite 121 Jasper GA 30143.

Georgia exempts a property owner from paying property tax on. Georgia now joins Iowa and Mississippi as the third state this year to amend its tax code for a flat rate. The Georgia Personal Property Tax Exemptions Amendment also known as Amendment 14 was on the ballot in Georgia on November 3 1964 as a legislatively referred constitutional.

Items of personal property used in the home if not held for sale rental or other commercial use. Business inventory is exempt from state property taxes as of January 1 2016. Georgia Code 48-5-41 The general rule for all exemptions is.

Nonresidents that have real or personal property located in Georgia are. Local state and federal government websites often end in gov. 2016 Georgia Code Title 48 - Revenue and Taxation Chapter 5 - Ad Valorem Taxation of Property Article 2 - Property Tax Exemptions and Deferral Part 1 - Tax Exemptions 48-5-41.

People who are 65 or older can get a 4000 exemption. Georgia Individual Income Tax is based on the taxpayers federal adjusted gross income adjustments that are required by Georgia law and the taxpayers filing requirements. All tools and implements of.

You can use our free Georgia income tax calculator to get a good estimate of what your tax liability will be come April. The Georgia Tax Exemptions for Farm Equipment Referendum also known as Referendum A was on the ballot in Georgia on November 7 2000 as a legislatively referred. The average family pays 187600 in Georgia income taxes.

Intangible personal property is not taxed All business personal property assets must be. Almost all 93 percent of Georgias counties and over 140 of the cities have adopted a Level One Freeport. Property Tax Exemptions Page 6 Taxpayer Bill of Rights Page 11 Property Tax Appeals Page 13 Franchises Page 15.

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

The Ultimate Guide To Property Tax Laws In Georgia

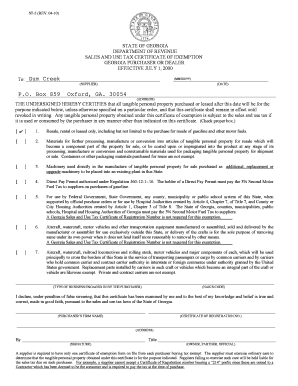

Fillable Online Georgia Dealer Tax Exemption Form St 5 Fax Email Print Pdffiller

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Georgia Department Of Revenue Caveat 2010 Mav For Personal Property Expanded Freeport Inventory Elimination Of Ad Valorem Tax On Business Inventory Heavy Ppt Download

Exemptions Gordon County Board Of Assessors

Property Tax Homestead Exemptions Itep

Form St Ch 1 Fillable Application For Certificate Of Exemption For Nonprofit Child Caring Institution Child Placing Agency And Maternity Home Rev 07 04

Republic Of Georgia Tax Paradise For Natural Person Entrepreneurs

Tax Assessor Information For Residents Walton County Ga

Georgia Department Of Revenue Caveat 2010 Mav For Personal Property Expanded Freeport Inventory Elimination Of Ad Valorem Tax On Business Inventory Heavy Ppt Download

Exemptions To Property Taxes Pickens County Georgia Government

Property Tax Calculator Estimator For Real Estate And Homes

Tangible Personal Property State Tangible Personal Property Taxes

Georgia Seller S Permits Ga Business License Filing Quick Easy